- spain@spectrum-mortgages.com

- +34 936 658 596

Interest rates – September 2023

Interest rates – September 2023

Many clients are expressing surprise at current high interest rates. Let’s delve into the situation surrounding Euribor, which plays a pivotal role in determining the interest rates offered by banks to their clients, both savers and borrowers.

Euribor, an abbreviation of the Euro InterBank Offered Rate, refers to the price at which European banks lend money to each other. This flow of capital between banks, from those who have funds to lend, to those that wish to borrow, allows the financial system to operate efficiently. Euribor is largely governed by the ‘base’ rate set by the European Central Bank (ECB).

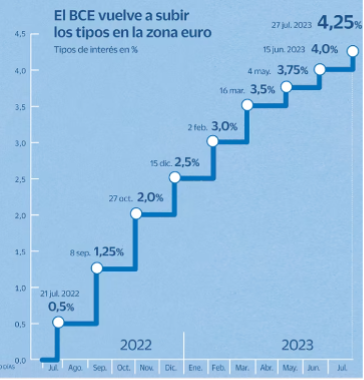

In September, the (ECB) made a significant decision to raise interest rates for the tenth time, with a quarter-point hike, bringing the rate to 4.5%. The possibility of another increase is not completely ruled out and the likelihood of a rate cut in 2024 has diminished. If such a cut does occur, it would probably happen later in the year or even in 2025.

This series of rate hikes is the most substantial since the inception of the single European currency. While the ECB’s move sends a strong message about its commitment to tackling inflation, it has also sparked debate about whether these actions might be excessive, potentially repeating past errors which took a long time to correct.

Economists at Eurobank have revised their economic growth projections downward. Christine Lagarde, the President of the ECB, has also warned that Eurozone countries are heading towards a period of slower growth.

Currently, there are two prevailing views within the ECB. The first is that the rate increases have already started to dampen credit demand and cool down the economy, potentially leading to more moderate inflation rates, without the need for further rate increases. The second perspective places emphasis on the Eurozone’s 5.3% inflation rate, which more than doubles the bank’s targeted price stability rate set at 2%.

With further analysis, wider debate may emerge on whether responsive action by the ECB, and central banks globally, fully recognised or addressed the underlying causes of post-pandemic inflation. That is a question for another time.

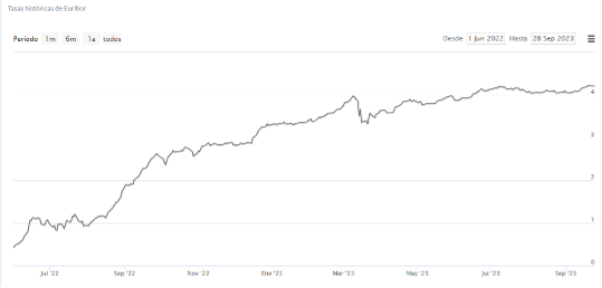

More relevant now is that in just 15 months, from June 2022 to September 2023, EURIBOR has surged from 0.417% to a staggering 4.208%. This striking trajectory is reflected in the following graph:

When examining historical data, we can see that interest rates have now reached the levels of November 2008, and although we have not yet surpassed the peak rates recorded in 2007 and 2008, we are drawing close.

Given these developments, the interest rates available from banks have risen significantly over the past 15 months. Many banks are reluctant to provide fixed-rate mortgage options, and if they do, these rates tend to be relatively high due to the risk of further rate rises by the ECB.

Should you have any inquiries regarding the content of this article, or any other questions relating to mortgages in Spain, please do not hesitate to reach out to us for further information.

Patricia Nadal: