- spain@spectrum-mortgages.com

- +34 936 658 596

Property prices in Spain

Property prices in Spain

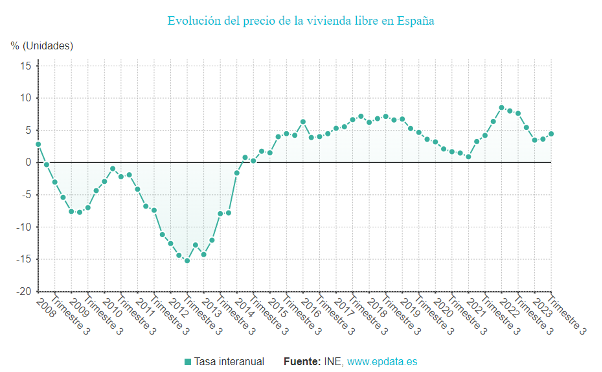

The evolution of housing prices in Spain has been a topic of great interest for many years. From the real estate bubble that culminated in the 2008 financial crisis, to the gradual recovery that followed, the Spanish real estate sector has gone through various phases of growth and contraction.

After the bursting of the real estate bubble in 2008, Spain faced a major economic and financial crisis. Property prices dropped substantially, with declines of more than 30% in some areas. The oversupply of housing and the credit crisis were key contributory factors in this downturn.

Starting in 2014, the real estate market began to show signs of stabilisation. Prices settled and, in some places, began a modest recovery. Economic growth, improved consumer confidence and government economic policies supported this recovery phase.

Then, even with a few interruptions to growth along the way, prices increased significantly across the market. Factors such as a limited supply of new homes, growing demand, foreign investment and low interest rates encouraged this upward shift in prices.

If we look at the evolution by Community, we see that there are wide regional variations in price increases. Several communities have surpassed pre-2008 record highs, notably in the Balearic Islands and the Canary Islands.

For the Balearic Islands, average prices reached record highs last month, December 2023, at €4,083 per square metre. This represents an interannual increase of 12.6%, far exceeding the record of €2,586 reached in February 2007 (preceding the subsequent market downturn).

In the Canary Islands, prices reached €2,432 per square metre, a year-on-year increase of 15.9%, surpassing the record of €2,084 in May 2007.

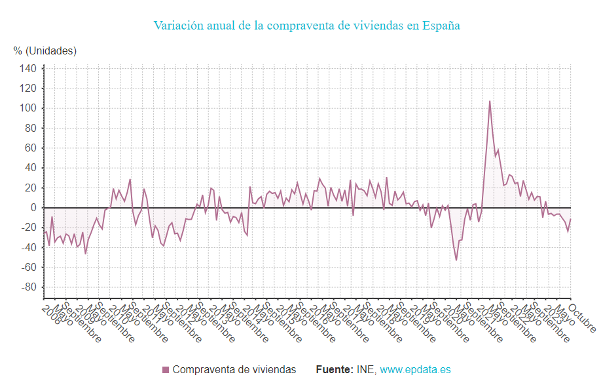

However, linked largely to rising interest rates (you can read an article about this here ), purchases and sales of homes have since slowed across the country. For example, for September 2023 compared to the same month of the previous year, the number of transactions decreased by 23.7%.

When inflation began accelerating in 2021, purchase transactions continued for a while without significant disruption but, a couple of months later, as it appeared inflation was persistent, the market began to slow.

By mid-2022 the central banks had embarked on monetary policies to tackle inflation. At the end of 2023, with central banks signaling the likely end of further interest rate increases, and with expectations of rate cuts being underway in 2024, we can observe improvement in buyer confidence and a corresponding pick-up in property prices. The evolution of the market continues.

Should you have any inquiries regarding the content of this article, or any other questions relating to mortgages in Spain, please do not hesitate to reach out to us for further information.

Patricia Nadal: